One sign of a terrible economy, to me, is how many times per week I discuss with a client how foreclosure works. Clients are worried about foreclosure, but they are especially fearful that the foreclosing lender will obtaining a deficiency judgment against them. If you check any real estate advice website like Trulia, there are many, many people asking about the effects of foreclosure and how deficiency judgments work. (Update: Illinois courts are now entering deficiency judgments routinely on first mortgages. This post discusses the increase in deficiency judgments.) Here’s how deficiency judgments work in Illinois:

Are deficiency judgments allowed in Illinois?

Yes.

What is a deficiency judgment?

If a property is foreclosed, it is sold at a sheriff’s sale. If the property owner owed $100,000 on his mortgage when he was foreclosed, and the property is sold at the sheriff’s sale for $80,000, then the lender can get a deficiency judgment for $20,000.00. This means a court order is entered saying that the owner owes the lender $20,000.00. (As discussed below, obtaining a judgment and actually collecting the judgment are two different things.)

When is a deficiency judgment entered?

Usually, the deficiency judgment is requested in the foreclosure complaint. The judgment is entered at the foreclosure sale confirmation hearing after the sheriff’s sale at the end of the foreclosure.

Can the lender get a deficiency judgment if I was served by publication in the foreclosure?

No. You have to be personally served by the sheriff or process server. The lender cannot get a deficiency judgment if you were served by publication (as many homeowners are). Another way to get a deficiency judgment entered against you is if you file an “appearance” in the foreclosure case.

What are the chances of the lender coming after me for a deficiency judgment?

If the property was your primary residence, the chances are slim (my estimate, totally unsupported by facts or statistics, is 5%) that a deficiency judgment will be entered. Very few deficiency judgments are being entered in Cook County according to attorneys I know who practice in the foreclosure area. If the foreclosed property was investment property ,or the mortgage was held by a small local lender, then the chances of a deficiency judgment increase greatly.

What can the lender take from me if they get a deficiency judgment?

A deficiency judgment is like any other judgment that is entered for an unpaid medical bill or unpaid credit card. After the judgment is entered, the judgment holder serves you with a “citation to discover assets” and you have to go to court and produce a copy of your tax return and a list of your assets. They use this information to garnish your wages or to take any non-exempt assets from you to pay the judgment.

What assets are exempt from collection after a deficiency judgment?

These items are exempt from judgment: Life insurance, 401ks, IRAs, $15,000 in equity in a house ($30,000 for a married couple). If your house is titled as Tenancy by the Entirety (married couples and primary residence only) and provided the judgment is only against one, not both, of a married couple, then the entire house would be exempt. Since we are talking about a foreclosure, it is unlikely that the judgment debtor will even have a house to worry about. 85% of wages are exempt from garnishment too.

How can I get rid of a deficiency judgment?

The only way to get rid of a deficiency judgment is to file a chapter 7 or chapter 13 bankruptcy. A chapter 7 wipes it out altogether. In a chapter 13, it is partially repaid.

Can’t I just give my other assets to my relative to hold for me?

You can gift assets to a relative. But any transfer to a relative or anyone else that is not “for value” can be undone as a fraudulent transfer. Transfers to relatives are especially suspect. In addition, there is the risk that your relative will not repay you or may get divorced or file his or her own bankruptcy.

If my lender does not ask for a deficiency judgment in the foreclosure, can my lender file suit against me for a deficiency judgment after the foreclosure?

Yes, Illinois law specifically allows a lender to file suit against a borrower after a foreclosure as a separate collection lawsuit. With first mortgages, this is very rare and most likely will not happen, unless the lender is a small bank or the property was not your primary residence. Some lenders holding foreclosed second mortgages (especially Citibank and Wells Fargo) now hand over the loans to collection agencies to file a separate lawsuit against the homeowner for breach of contract. Read more about that here.

Can my lender file suit against me for a deficiency judgment after I sell my house in a short sale?

Yes. The best practice is to negotiate a “no deficiency” provision in your short sale. If you can’t get that from the lender, then you will have to wait it out and hope that the lender does not ask for a deficiency judgment in the future. Most likely they will not pursue the borrower, but you never know for sure.

If I deed my property back to my lender in a “deed in lieu of foreclosure” can my lender get a deficiency judgment against me later?

No. The lender cannot get a deficiency judgment. Unfortunately, a deed in lieu of foreclosure is kind of the equivalent of a unicorn; one doesn’t exactly show up in your back yard every day.

How long is a deficiency judgment last?

A judgment in Illinois is valid for 7 years from the date it is entered.

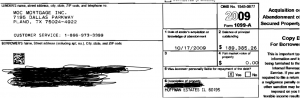

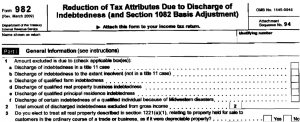

I’ve heard that in a foreclosure my lender can 1099 me for “forgiveness of debt.” Can they 1099 me and get a deficiency judgment against me too?

Usually, if a lender 1099s you, the lender will not seek a deficiency judgment. This is just how lenders operate, not the law. By law, the lender must issue a 1099 after a foreclosure or short sale. The issuance of the 1099 does not mean that the debt is erased by the lender. It just means that the forgiven debt is taxable to you.

If the lender 1099s you and later seeks a deficiency judgment, the lender would have to issue a revised 1099, that’s all. So the issuance of a 1099 does not bar a deficiency judgment. Technically, the lender can 1099 you AND file for a deficiency judgment. You have to keep in mind that the lender could still get a deficiency judgment after a 1099 is issued. The only sure elimination of both the 1099 and deficiency judgment is to file bankruptcy before the 1099 is issued.

There are several cases that deal with this topic: In re Zaika, a PA bankruptcy court case and AmTrust v. Fossett in AZ are a couple that summarize the law.

If the foreclosed property was your primary residence,then you have no income from the 1099 by law under the Mortgage Debt Forgiveness Act. If the property was not your primary residence, then you will have phantom income from the 1099 to deal with.