We have been waiting for the new Form 5405 from IRS to claim the $8000 first-time buyer tax credit and the $6500 move-up buyer tax credit. The form was just issued on January 15, 2010. Click here to get the form and instructions. This form must be used for all closings after November 6, 2009.

All posts by tsammons

Foreclosure and deficiency judgments

One sign of a terrible economy, to me, is how many times per week I discuss with a client how foreclosure works. Clients are worried about foreclosure, but they are especially fearful that the foreclosing lender will obtaining a deficiency judgment against them. If you check any real estate advice website like Trulia, there are many, many people asking about the effects of foreclosure and how deficiency judgments work. (Update: Illinois courts are now entering deficiency judgments routinely on first mortgages. This post discusses the increase in deficiency judgments.) Here’s how deficiency judgments work in Illinois:

Are deficiency judgments allowed in Illinois?

Yes.

What is a deficiency judgment?

If a property is foreclosed, it is sold at a sheriff’s sale. If the property owner owed $100,000 on his mortgage when he was foreclosed, and the property is sold at the sheriff’s sale for $80,000, then the lender can get a deficiency judgment for $20,000.00. This means a court order is entered saying that the owner owes the lender $20,000.00. (As discussed below, obtaining a judgment and actually collecting the judgment are two different things.)

When is a deficiency judgment entered?

Usually, the deficiency judgment is requested in the foreclosure complaint. The judgment is entered at the foreclosure sale confirmation hearing after the sheriff’s sale at the end of the foreclosure.

Can the lender get a deficiency judgment if I was served by publication in the foreclosure?

No. You have to be personally served by the sheriff or process server. The lender cannot get a deficiency judgment if you were served by publication (as many homeowners are). Another way to get a deficiency judgment entered against you is if you file an “appearance” in the foreclosure case.

What are the chances of the lender coming after me for a deficiency judgment?

If the property was your primary residence, the chances are slim (my estimate, totally unsupported by facts or statistics, is 5%) that a deficiency judgment will be entered. Very few deficiency judgments are being entered in Cook County according to attorneys I know who practice in the foreclosure area. If the foreclosed property was investment property ,or the mortgage was held by a small local lender, then the chances of a deficiency judgment increase greatly.

What can the lender take from me if they get a deficiency judgment?

A deficiency judgment is like any other judgment that is entered for an unpaid medical bill or unpaid credit card. After the judgment is entered, the judgment holder serves you with a “citation to discover assets” and you have to go to court and produce a copy of your tax return and a list of your assets. They use this information to garnish your wages or to take any non-exempt assets from you to pay the judgment.

What assets are exempt from collection after a deficiency judgment?

These items are exempt from judgment: Life insurance, 401ks, IRAs, $15,000 in equity in a house ($30,000 for a married couple). If your house is titled as Tenancy by the Entirety (married couples and primary residence only) and provided the judgment is only against one, not both, of a married couple, then the entire house would be exempt. Since we are talking about a foreclosure, it is unlikely that the judgment debtor will even have a house to worry about. 85% of wages are exempt from garnishment too.

How can I get rid of a deficiency judgment?

The only way to get rid of a deficiency judgment is to file a chapter 7 or chapter 13 bankruptcy. A chapter 7 wipes it out altogether. In a chapter 13, it is partially repaid.

Can’t I just give my other assets to my relative to hold for me?

You can gift assets to a relative. But any transfer to a relative or anyone else that is not “for value” can be undone as a fraudulent transfer. Transfers to relatives are especially suspect. In addition, there is the risk that your relative will not repay you or may get divorced or file his or her own bankruptcy.

If my lender does not ask for a deficiency judgment in the foreclosure, can my lender file suit against me for a deficiency judgment after the foreclosure?

Yes, Illinois law specifically allows a lender to file suit against a borrower after a foreclosure as a separate collection lawsuit. With first mortgages, this is very rare and most likely will not happen, unless the lender is a small bank or the property was not your primary residence. Some lenders holding foreclosed second mortgages (especially Citibank and Wells Fargo) now hand over the loans to collection agencies to file a separate lawsuit against the homeowner for breach of contract. Read more about that here.

Can my lender file suit against me for a deficiency judgment after I sell my house in a short sale?

Yes. The best practice is to negotiate a “no deficiency” provision in your short sale. If you can’t get that from the lender, then you will have to wait it out and hope that the lender does not ask for a deficiency judgment in the future. Most likely they will not pursue the borrower, but you never know for sure.

If I deed my property back to my lender in a “deed in lieu of foreclosure” can my lender get a deficiency judgment against me later?

No. The lender cannot get a deficiency judgment. Unfortunately, a deed in lieu of foreclosure is kind of the equivalent of a unicorn; one doesn’t exactly show up in your back yard every day.

How long is a deficiency judgment last?

A judgment in Illinois is valid for 7 years from the date it is entered.

I’ve heard that in a foreclosure my lender can 1099 me for “forgiveness of debt.” Can they 1099 me and get a deficiency judgment against me too?

Usually, if a lender 1099s you, the lender will not seek a deficiency judgment. This is just how lenders operate, not the law. By law, the lender must issue a 1099 after a foreclosure or short sale. The issuance of the 1099 does not mean that the debt is erased by the lender. It just means that the forgiven debt is taxable to you.

If the lender 1099s you and later seeks a deficiency judgment, the lender would have to issue a revised 1099, that’s all. So the issuance of a 1099 does not bar a deficiency judgment. Technically, the lender can 1099 you AND file for a deficiency judgment. You have to keep in mind that the lender could still get a deficiency judgment after a 1099 is issued. The only sure elimination of both the 1099 and deficiency judgment is to file bankruptcy before the 1099 is issued.

There are several cases that deal with this topic: In re Zaika, a PA bankruptcy court case and AmTrust v. Fossett in AZ are a couple that summarize the law.

If the foreclosed property was your primary residence,then you have no income from the 1099 by law under the Mortgage Debt Forgiveness Act. If the property was not your primary residence, then you will have phantom income from the 1099 to deal with.

Best “cloud” programs

It’s become common to have computer programs hosted in the “cloud.” My favorite cloud programs are below:

(I use and like gmail, google calendar a google tasks alot, but they are so well-known I left them out)

- Dropbox. I love this program. Any file that is saved in My Dropbox (which is just a folder in the My Documents area) is synched with all other computers. I synch all of my files on 3 computers and my I phone. I can access any of these files from any or all of these, including the I phone, anywhere there is internet access. The dropbox interface is clean and easy to understand. This program is a total winner. It’s free too, up to 3 GB of storage. I pay for the $99 yearly upgrade to store 50 GB.

- Dragon I phone application. I use Nuance’s Dragon voice dictation system on my main computer at work, although not as much as I used to. In December, the company released a free Iphone application that lets you dictate into the I phone and then you can email or text the resulting message. It’s a big time saver and provides a break from the tyranny of typing messages into the I phone. It recognizes speech very well.

- Timedriver. This is my second favorite program. Timedriver lets clients make appointments without playing phone tag forever. I have a link on my website that the client clicks. The client chooses a time and date and then the appointment is put in my Google calendar automatically. The cost of this is $30 per year and it’s worth 10 times that amount.

- Basecamp. This is an extranet program that I have used for three years for active real estate and trust and estate planning matters. It is phenomenal and costs only $49/mo. Clients are notified by email if a new file or email is posted to their private extranet. File sharing and email sharing are made simple with Basecamp.

- Highrise. I used ACT contact manager for years. ACT had a bloated upgrade every year and had too many features for my humble office, so I switched to Highrise about three years ago. It is $24.00 per month and is a basic, utilitarian contact manager for storing notes, email and data about a client, but it works for me.

- Authorize.net. I ‘ve accepted credit cards from clients for years. Last year I got rid of my account with Moneris and my expensive card-swiping machine. I applied for an authorize.net account using powerpay.biz. This is an internet payment gateway that allows me to accept credit cards online. I no longer have a card swiping machine. I can take credit cards on my Iphone, but I generally use Freshbooks, described below, to email an invoice to a client and the client pays by credit card online. Works wonderfully.

- Freshbooks. Freshbooks is a time-tracking and invoicing program. I used Quickbooks for invoicing for years, but once I tried Freshbooks I never went back to Quickbooks (for invoicing that is; I still use it as a basic accounting program). With Freshbooks, you can send invoices by email to the client and the client can either print the invoice and mail a check, or pay by credit card online (you need an authorize.net account for this feature to work). The interface is clean and easy to use. I pay about $20/month and it’s well worth it.

- Evernote. Evernote is a free program that lets you capture clips of websites. This replaced delicious for me and I use it to bookmark sites. There is an easy-to-use Firefox add-on that lets you capture any site in a single click. The best part about it is the Iphone application that remembers all of the sites for easy access anywhere.

- Jungledisk. This is a good file backup site. You pay only for what you upload to the site and it’s worked well for me so far. Once you select the files or folders that you want to backup, the software takes care of it for you every day.

Update on new short sale rules

Everyone is tired of short sales because only about 20% ever close. Some lenders have started to automate short sales, which may help.

The newest thing in the short sale arena is a program starting in April 2010 that supposedly will simplify short sales. The new program is called HAFA (Home Affordable Foreclosure Alternatives). It is incredibly complicated (like most government programs) and it does not apply to Fannie Mae (FNMA) loans. FNMA loans account for about 55% of all mortgages.

This wonderful post summarizes the HAFA program very well. HAFA is a sister program to HAMP, which is the totally ineffective mess of a program that tries to help homeowners modify their mortgages. Loan modifications have been so unsuccessful that a homeowner has almost as good of a chance of winning the lottery as having his or her loan modified. In fact, before pursuing a short sale approval under HAFA, the homeowner has to first apply for, and not qualify for and be denied or not complete, a loan modification under HAMP (that shouldn’t be too hard since none of the modification programs work at all).

A lender that chooses to participate in the HAFA short sale program will be paid by the US government. Hopefully, this will be enough of an incentive to get lenders to participate in the short sale program.

Here are some good things about the HAFA short sale program:

1. The homeowner/seller can get “pre-approved” by the lender for a short sale.

2. The homeowner must be released from future liability.

3. Real estate commissions can’t be reduced by the lender.

4. Best of all, the program sets timelines for responses by the lender. Short sales so far have been slow moving death marches that average about 6 to 7 months to get an approval. The lender has 10 business days to respond to a short sale offer.

Some not so good things about HAFA:

1. Must first apply for HAMP loan modification (have fun with that… virtually none of these get approved).

2. Must be borrower’s primary residence, no investment properties.

3. Mortgage must be delinquent (some short sales are current).

4. Complicated program with 43 pages of instructions.

Overall, I would say that this is a step in the right direction and an attempt to bring order to the short sale maze.

Estate tax vanishes Jan 1: But watch out for capital gains tax

If you thought inheritance taxes were complicated before, just wait for January 1.

The inheritance tax is abolished starting January 1. But it only stays abolished until December 31, 2010. On January 1, 2011, the old inheritance tax system returns, except that the amount that is free of inheritance tax changes to $1 million per person. Make sense? Of course not.

There is a new wrinkle that makes it all even more confusing. It’s this: Under the “old” system that expires December 31, 2009 and the new system that starts January 1, 2011, assets that the deceased owned received a “stepped-up basis.” This means that the value of an asset is reset to its value on the deceased’s date of death. For example, if a client bought a house in 1980 for $100,000 then died in 2009 when the house was worth $300,000, and the house was sold after the deceased’s death, so no capital gains tax was due when the asset was sold because the “basis” or cost of the house was increased to $300,000. This applied to all property owned by the deceased.

Well, the stepped-up basis rules all change on January 1, 2010. Now, “stepped-up basis” is replaced by the term “carry-over basis.” This means that the basis of the deceased property owner carries over to the heirs and is not stepped-up (but of course there are exceptions, naturally). If the asset is sold, capital gains tax must be paid by the heirs.

The new rules on carry-over basis are:

- $1.3 million or less in property still gets a stepped up basis.

- Any amount inherited over $1.3 million does not get a stepped-up basis. If this property is sold, capital gains tax will be paid by the heirs on the gain.

- An additional $3 million can be left to a surviving spouse and will get a stepped-up basis.

Complicating matters even more, Illinois decoupled from the federal inheritance tax system for a few years. This made is possible for large estates of over $2 million to pay inheritance tax to Illinois, but not to the U.S. Thankfully, for 2010, there is no Illinois inheritance tax to worry about.

What to make of all this? It is wise to review your will or trust with your attorney to address these complicated and ridiculous rules to be sure that you don’t call into a carry-over basis trap.

Still waiting for new form 5405

For closings after November 7, 2009, a new form 5405 is required to file for the $8000 first-time buyer tax credit and the $6500 move-up buyer tax credit as I discussed here.

Please don’t use the 2008 Form 5405 for closings after November, 7, 2009, because your tax refund will not be processed.

The IRS website is saying that the new form will be issued by January 8, 2010, so it won’t be too much longer.

What’s easier: Modify your loan or win the lottery?

A loan modification happens when a homeowner is a few months behind on mortgage payments. The lender agrees to modify the loan and adds the missed payments to the end of the loan in an attempt to help the homeowner avoid foreclosure.

The problem is that lenders reject many applicants for loan modification and most of those granted are temporary. Matt Hernacki points out that a homeowner has about the same chances of winning the lottery as he or she does of getting a loan modification.

All of the generic media stories about foreclosure tell homeowners to “communicate early” with their lender. It’s a sad truth that the lenders are overwhelmed with delinquent mortgages. They really have no interest in talking with borrowers. They pay lip service to loan modifications and really do nothing to help the homeowner in trouble.

Buyers will need to wire funds to closing

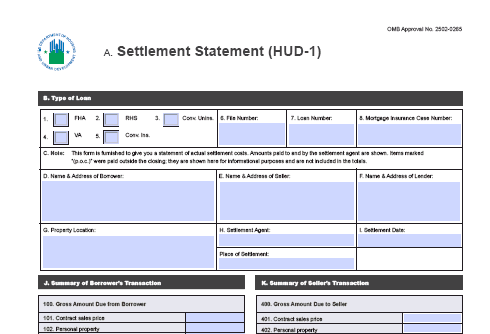

In addition to the new HUD-1 form that will have to be used for closings after January 1, 2o10, buyers will have to wire funds to closing if they owe more than $50,000.00 to close.

Very few buyers wired funds to closing in the past. Most obtained a cashier’s check for the funds due at closing. Cashier’s checks will still be accepted for amounts under $50,000.oo. The definition of “good funds” will include a title company check obtained from a sale closing.

New HUD-1 form released

Anyone that participates in real estate closings is dreading the new HUD-1 form that is required beginning 1/1/10.

The new HUD-1 form (this is the closing statement that shows all of the sellers and buyers costs and their “bottom lines”) includes a third page that references the good faith estimate given to the buyer by the lender. It directly compares the figures from the good faith estimate with the final, actual figure.

It’s a step in the right direction, but it strikes me as complete overkill. Predatory, overcharging lenders were a problem 4 years ago, not now.

Wait for new form to file for real estate tax credit

It’s great that the$6500 move up buyer tax credit was added and that the $8000 first-time buyer credit was extended. But, IRS is advising buyers to wait until the end of December to file for the tax credit until it issues a new form 5405 that reflects the new changes.

Real estate writer Ken Harney (a consistently excellent writer) says that if you file for the credit using the “old” form 5405 (which is still on the IRS website), it is likely that the tax rebate will linger or not be processed at all.

So anyone who bought after November 6 of this year should wait until later this month for the new form 5405 before amending their 2008 taxes.